With the current give and take on ZIRP and SP500 at record level and DOW breaching 18,000, and quasi-millennialist concepts like "Secular Stagnation" or "New Normal" - thought it would be useful to look at the long term view. The following shows not much has changed for the USA in terms of likely growth. The impact of demographics on the USA may have certain immediate tactical importance - for example as the Great Recession led to early retirement for "Boomers" or for certain sub groups like Hispanic women. ( Hotchkiss, Atlanta Fed "Adjusted Employment to Population Ratio As An Indicator of Labor Market Strength" ) but in the end demographics is not a independent or causal variable but is dependent and acts as an identity in being a main attribute to growth. So too with productivity, the other attribute to US growth, which will wax and wane not because of any stagnation or boom, but in terms of the expected duration of the users/creators of the changed productivity. Productivity in the long run is a dependent and an identity, as is demographics/population. Inflation is the third attribute to nominal growth, and it is also a dependent and also acts as an identity.

The independent variable for US nominal growth, or NGDP, is the amount of profit that can be produced given the current US setting. And if population, productivity and inflation are dependents, then the amount of profit that can be produced is a optimization problem given the current legal and security setting of US corporates. During some phases inflation is stressed and at other times population - and so on. And that legal setting is the US Constitution and the US "rule of law" applied to US corporations. The USA, since it entered the globalized world in being the deciding force for WWI and thereby the lead at the peace conference, creates the mix of inflation, productivity and population required to maximize profit, given the main challenge to the US Constitution and thereby maintaining the capitalist liberal democracy system.

The independent variable for US nominal growth, or NGDP, is the amount of profit that can be produced given the current US setting. And if population, productivity and inflation are dependents, then the amount of profit that can be produced is a optimization problem given the current legal and security setting of US corporates. During some phases inflation is stressed and at other times population - and so on. And that legal setting is the US Constitution and the US "rule of law" applied to US corporations. The USA, since it entered the globalized world in being the deciding force for WWI and thereby the lead at the peace conference, creates the mix of inflation, productivity and population required to maximize profit, given the main challenge to the US Constitution and thereby maintaining the capitalist liberal democracy system.

Therefore, it is the security of the USA which will define in the end profit realized and potential - or more simply put it is war which defines the USA profit attributes and growth. And thereby it is war which define the NGDP of the USA and how the three main factors of NGDP are weighted in terms of population, productivity and inflation.

Examining how these basic factors to USA NGDP have developed over the last century, 4 distinct long phases can be identified. The story of US growth for the last century, and subsequent SP500 levels, has been the common denominators with each of these 4 phases. The business cycle, where most begin and end any analysis of growth and markets, is merely an overlay to these phases. Even a casual memory shows that the phases are based upon war.

1. The German War 1914 to 1946

2. Cold War I 1947 to 1967

3. Cold War II 1968 to 1988

4. US Ascendancy 1989 to 2014

1. The German War 1914 to 1946

2. Cold War I 1947 to 1967

3. Cold War II 1968 to 1988

4. US Ascendancy 1989 to 2014

Within these 4 phases the breakdown of contribution to NGDP from population, productivity and inflation is somewhat consistent considering the huge differences and challenges unique to each phase, but that uniqueness does effect the weights of each factor. The ability to maximize profits through optimizing the three factors does vary on nominal terms, especially as large changes in inflation are required in a certain phase to maximize nominal profit - but real GDP is, over the long run, a very steady 3% plus growth. It is this ability to maintain a consistent business setting which allows the US to optimize the three factors that has made the USA the behemoth power that it is today.

The factors weights of NGDP growth, the contribution weights, are population adding about 20%, productivity about 36% and inflation the rest of about 48%. While the business cycles overlaid onto these phases are complex and each cycle unique - from the super cycles of the Great Depression and the Great Recession to the minor business cycles that play out every 4 to 10 years - each phase can be identified and framed by the national conflict or war that was central for that specific phase. Even the latest phase - US Ascendancy - is defined by the issue of insurgency to the US cultural and economic hegemony.

It is the nature of the war prevailing that will define the economy and the nature of the growth the USA experiences.

When the phase war is not one of attrition but one of conquest and domination, US productivity surges as the duration of forward expectations can extend making investment to produce such productivity less risky, but when the phase war is one of attrition, as it was in phase Cold War II, from the worst of Viet Nam morass to the final caving of the USSR in 1989, productivity is almost halved as the duration for forward expectations is halved as risk increases. Anyone born prior to 1960 can remember as a young child being woken at night by a siren and always wondering if this was the night the Russians attacked and nuclear war commenced. When the USA entered the post USSR phase of hegemony, the Ascendancy phase - despite the popular generally gloomy economic and political narrative that has almost been constant in this phase - productivity and population doubled from the attrition of the Cold War II phase as risk to forward expectations dramatically declined. And despite the terror of 9/11 and the so called "failed" wars of Afghanistan and Iraq, few Americans than ever as a percent of the populace saw war, and the world became undeniably safer and safer as insurgency against the American hegemony was dealt with.

While NGDP varies, real GDP is stable around 3.2% for the last century. Inflation is the "buffer" , a sector identity such that the results are a steady, or optimization of nominal corporate profits so that real GDP is kept steady.

The above is the basic axioms of Minsky-Keynes depiction of the US economy. All other powers that have been authoritarian based, or corporatists (fascism), socialist or communists, and that have come to depend upon a globalized economy then have had no choice but to attack the USA for they are quickly put into a zero sum world where either the US system or their system prevails. That results in war, and is why the USA has been defined by war, or the USA capitalist liberal democratic system with profit maximization at its core, is always being tested or challenged even to the point of possible destruction. That in this warrior nation state, the drive to maximize capitalist profit (which are more often than not the opposite to rentiers profits) prevail and is our defining characteristic - not a "people" or religion or geographic area.

The USA is a capitalist liberal democracy, and this defining characteristics has been the cause of all the wars for the last century, as state corporatism of the Germans, and then the Marxist-Stalinist socialism of the USSR, realized that they were in a struggle to the death with the USA as their forms of government were mutually incompatible with the USA capitalist liberal democracy and they would cease to exist unless the USA was eliminated or changed to a different system.

The Table:

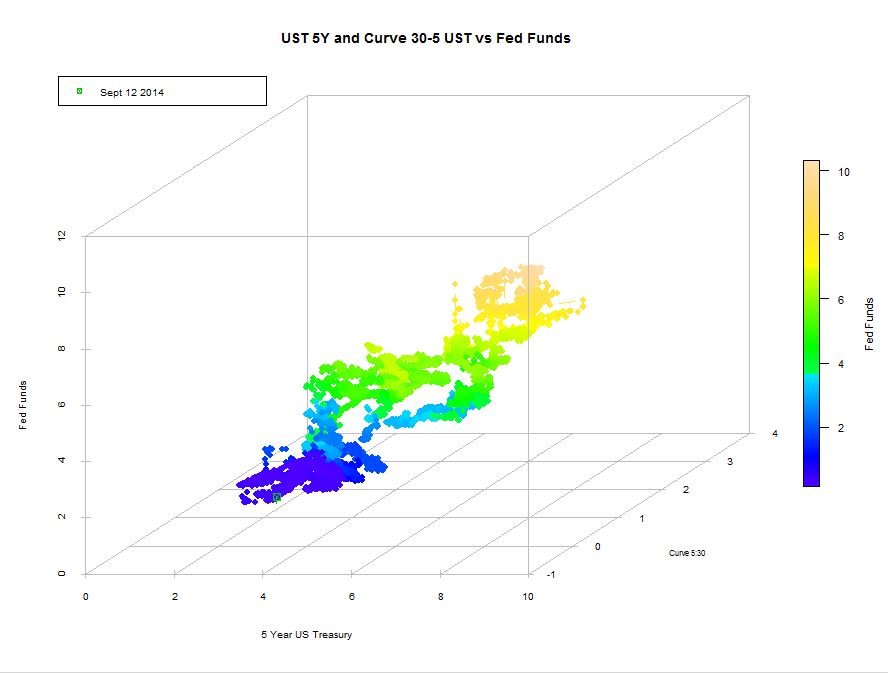

The current ratio of the growth of SP500 to NGDP is at the highs for the last century. That the average ratio has been where the SP500 growth is 1/3 of the NGDP. Why this change? When the war threatens the survival of the USA, SP500 lags terribly, and in addition to this risk if the war is one of attrition, as it was in the dark second phase of the Cold War, most of NGDP growth, and thereby to make the required nominal capitalistic profit, is provided by inflation. Now that has been reversed, matching the perhaps hubris of the USA immediately after Hiroshima and the smashing of the German corporatism model.

Yellen and company have it all wrong, as long as the USA is empowered for war, able to fight war such that it is reasonable to see the USA prevail, inflation is not something that can be generated nor really curtailed, but is rather an identity responding to the USA security policy. The Fed can only be an administrator and make the best of the phase war for the period,and can only focus upon inflation in the end. And by focusing on inflation the Fed can only seek to have the necessary changes inflation move discreetly. This is the purpose and the theory behind the Taylor Rule, to allow feedback such the Fed can make the necessary identity moves in inflation as effective as possible. In the end the Fed cannot curtail or encourage the inflation rate that will occur. The Federal Reserve is always, in the end, an administrator and every attempt at "policy" will only delay or unnecessarily speed up the monetary status that will occur. For in the end inflation is an identity, not a causal variable.

Population is also created or will be whatever is required, in the end, to maximize nominal capitalist profit. Whoever unlike any other form of government, with the liberal democracy such population results can only in the end be a good. The Malthusian concerns of "global warming" types or just about any demographic concern is something that will have nothing to do with any reasonable foreseeable economic time period. Malthusian and Millennialistic concerns should be seen for what they are - religiosity that is no longer fulfilled with traditional religion. If concepts like global warming - and I have no interest debating it here - are valid and are science, then they will simply be priced into profits as any cost and thereby be solved with the relentless pursuit of capitalist profit. Such is the power and beauty of a liberal democracy. This also means that all consideration of NGDP based upon demographics - all the ad nauseum of late on Boomers and their spawn is trite. What will be the demographics in the USA? I can answer with confidence and total predictive capability - it will be whatever maximizes capitalist profits. To me that means that there will be a relative resounding boom in immigration and perhaps the Mils will have more kids than one thinks at this point.

Population is also created or will be whatever is required, in the end, to maximize nominal capitalist profit. Whoever unlike any other form of government, with the liberal democracy such population results can only in the end be a good. The Malthusian concerns of "global warming" types or just about any demographic concern is something that will have nothing to do with any reasonable foreseeable economic time period. Malthusian and Millennialistic concerns should be seen for what they are - religiosity that is no longer fulfilled with traditional religion. If concepts like global warming - and I have no interest debating it here - are valid and are science, then they will simply be priced into profits as any cost and thereby be solved with the relentless pursuit of capitalist profit. Such is the power and beauty of a liberal democracy. This also means that all consideration of NGDP based upon demographics - all the ad nauseum of late on Boomers and their spawn is trite. What will be the demographics in the USA? I can answer with confidence and total predictive capability - it will be whatever maximizes capitalist profits. To me that means that there will be a relative resounding boom in immigration and perhaps the Mils will have more kids than one thinks at this point.

The other major attribute for growth, that contributes almost 1/2 of growth is productivity. That seems to be on track at the usual .45 weight.

Going forward the table in context of the true nature of the warrior America economy suggests that the current FOMC is assuming more power than it really has, that it will in the end only "shepherd" the inflation required and that all "extraordinary" measures will cease - likely not really required nor as important as all consider for a couple of years now.