I wrote this in Michael Pettis comment section in response to his brilliant posting today:

http://blog.mpettis.com/2014/10/how-to-link-australian-iron-with-marine-le-pen/

"How to link Australian iron to Marine le Pen"

My comment:

As usual brilliant, and you are frighteningly alone showing your academic courage. But I have some thoughts which I hope are additive.

It should be understood that it is not just that there is a curious Dornbush "suddenness" that resolves imbalances, but if those imbalances were built as policy, especially policy that at its heart is meant to provide societal control, increase government power or repair a perceived deficiency in power or alleviate a risk to power (Tienanmen) , or to counter a foreign security risk, the imbalances created by policy can only be resolved by "un-policy". In other words via catastrophe and jumps which will be weeks in the process versus the decades that the policy required to build those imbalances. Since imbalances created are the results of policy, it means by definition they have the current group in power committed "all in" on those imbalances. China may actually be able to remedy the imbalances by a change in policy based on Confucius ideals of the greater good -but that has never been accomplished in history be it the Athenian mercantilism to Roman wheat trade with Egypt to American housing market. So the odds as defined by history is that China will experience a very severe cataclysm ,right up there with a Yihetuan or Taiping event. I hope not, as that would result in war.

That is what is unsaid - maybe it has to be unsaid - that such imbalances are not just severe economic conundrums lacking sensible policy - but are always the cause of all war. These imbalances, therefore, are the most important foreign policy and security issue for the USA and all world governments. If they are successfully deflected from the international lines of transmission - for example the USA "ate" the first phase of the China imbalance resolution via the solvency event of 2008 - they will always cause at best intense internal insurrection or a civil war and at worst global war. Very serious stuff indeed.

These imbalances are intolerable for this globalized world.

Your ideas on Saravelos "Euroglut" are thoughtful. And Saravelos is thoughtful to approach Europe on an international identity perspective like the good Minskian I am sure he must be. But that glut does not exist in truth. The real imbalance is not that that Germany and a few Nord fellow travelers have excess savings and low demand, but that all of those savings are matched and then some by the deficit in the PIIGS. The T2 accounting has become ubiquitous such that it no longer terrifies or even really acknowledged . And the Nord EZ feel they have successfully forced the PIIGS into a long term acquiescence of the policy that built the T2 imbalances, and they will remedy those imbalances via labor. Thus the 50% youth unemployment in Greece today, near matched in Spain and Portugal. And with Italy starting to follow. This remedy though is a fiction, a Potemkin policy which is providing the illusion that the Nord have the ability to consider exporting their excess savings and deflation to the USA. What will happen is all those savings will be marked down so the entire EZ will net to levels the T2 net would now indicate (and then of course the "shadow" netting added as well) so that all that Euroglut goes "poof". Of course the last time Europe had this process WW II occurred, and it is telling that you went to Keynes "Consequences of the Peace". The only constructive answer that can work for Europe is that the T2 and other shadow imbalances are netted across Europe via transfer payments both spot and forward via trans-Europe unemployment insurance like payments and social security and health coverage. There is the small issue of a constitutional apparatus being built to administer this. So I do not think the "Euroglut" is of any risk to the USA.

What I do know is that the highest levels foreign policy formulation in the USA from the beginning of the Euro crisis were well aware of all I say above and anticipated the current status. I heard such discussion first hand. The USA policy formulated for the EZ crisis from 2011 on was to give Germany a "green light" to force PIIGS to use labor to maintain and work to remedy the EZ imbalances. That very capable US analysis calculated thresh hold levels of unemployment in the PIIGS that they feel could be maintained before insurrection and the return of fascism. That Fed Reserve support of the regional central banks along with one off ad hoc measures like the IMF "troika" would also assist in maintaining German hegemony of Europe. France would be bought off by calling this a Gaullist European solution. This was sought by the USA policy authors because of the obvious logic that the only possible competitor to United States hard power would be a Monnet Plan "United States of Europe". So the USA is supporting the German hegemony at the terrible cost of strapping the PIIGS, thereby keeping Europe in one vast chronic "frozen" economic crisis. The USA has no interest in seeing a land and naval force develop that would equal the US military. And a United States of Europe would have a land and sea force the complete equal to the United States.

Lastly you are wrong (said with respect), There is one economist who clearly anticipated both the USSR demise as well as the Japanese crash. Whats more she correctly predicted the "lost decade(s)" of Japan that followed the 89 crash. I am not certain that she was aware of this (but I would imagine this autodidact economist must have read Minsk), but she used a very clean application of Minskian like identities to global imbalances to reach insight. Whats more she freed herself from the national account data and considered the world as populated by large city-state economic regions and where the imbalances reside. For example she would focus on imbalances between Honshu and Tokyo and much as Japan to the United States. That person was of course the great Jane Jacobs. Just as you went back to "Consequences", a read now of "City and the Wealth of Nations" is a good use of time.

Sunday, October 19, 2014

Saturday, October 18, 2014

Common Sense Shows the Household Survey is in Error, Under-reporting Employment by 1 Million (5 1/8%)

If UER-6 and household survey unemployment rate (now at 5.9%) showed labor slack, a parallel status would be found in the insured unemployment data. Or the the ratio of insured labor force to total labor force would have changed significantly, dropping in similar fashion as the labor force participation rate.

But data clearly shows that the ratio of insured labor force to total labor force has been unusually steady, ever since the large influx of women entered the work force in the 1970s onward. The ratio of insured labor force to labor force does drop similar to the labor force participation rate drop, during the 2008 to 2009 business slowdown, but has corrected swiftly while the labor force participation rate has stayed unchanged.

The ratio of insured labor force to labor force has returned to levels experienced throughout the decade prior to the solvency event of 08.

The weekly initial claims and continuing claims data is accurate and timely. It is not a derived level or rate from a sample as it is comprehensive. But for the ARIMA seasonal adjustments, the insured claims is consistent and accurate and factual. It is what it is. The BLS and CES uses the state data to calibrate and revise the household survey which by definition is a sample, and the establishment business survey that derives payroll. The household and establishment data can only be accurately portrayed with little margin of error every 10 years with the census - but even then that window of accuracy comes as hindsight after the census data is ordered and cleaned. So BLS and CES depend on the above stable ratio to calibrate and revise the household and establishment data using the timely and comprehensive claims data. At least they have done so for the 40 years prior to 2008. But in this solvency event with both the slowdown and then the recovery, BLS and CES have not applied the claims data with the same rigor they have in the past. If they had done so, using the 80% to 85% insured to total labor force ratio, the unemployment rate would have experienced much higher rates at the economic nadir and then much lower rates as we recovered. It is obvious that given the insured labor force to labor force ratio relative stability, the household data is now in error and will have upward revision of approximately 1 million employed.

That would change the current 5.9% unemployment rate to 5.1% unemployment rate raising the labor force participation rate accordingly and eliminating the unusual spread between UER-6 and UER-3.

Here I take the weekly complete census of insured unemployment rate and divide continuing claims by that rate to end with a derived household unemployment rate using insured unemployment and the stability of the ratio of the subset insured labor force to labor force.

The last data point for both - August 2014 - is provided. The growing error in the household data by calibrating to the weekly claims census is obvious. It also shows the error is approximately .8 % in the unemployment rate or approximately 1 million employed.

The magnitude of this error is shown in the Beveridge Curve for insured unemployment and for household unemployment.

This shows the insured data coordinates to other impressions of the recovery like retail sales, consumer lending, durable goods and especially autos; while the household unemployment data is out of synch with other economic data, including the JOBS data.

Detailed and complex contortions explaining why the household survey is accurate are more and more frequent, but none of these discussions even bother to explain the census based claims data - since it cannot be done - it is simply dismissed or there is some sort of bizarro world parallel universe explanations that claims data only reflects the rate of layoffs. That of course makes no sense when one considers the continuing claims data which drops only as employment picks up.

So the insured data Beveridge Curve is the accurate and complete depiction of the nations employment status.

The reality is the employment levels are showing a near record if not record robust strength that can only occur with a consistent 4% real GDP. The unemployment rate when it is finally revised to the correct level will show that the current unemployment rate is about 5 1/8%.

This means that the FOMC is in the midst of one of the most significant policy errors in the history of the Federal Reserve since 1913. That the whole premise of "forward guidance" is in error as the inflation rate is not related to the output gap, and then the output gap now being used is in error as right now there is no labor slack left and, unless a new internet like technology flows into the economy as it did in the 1990s, heightening productivity, significant inflation given all the capacity being used will certainly occur.

But why is there no inflation now given a correct read of an extremely tight labor market? Where are the wage pressures that theory says should exist now.

That is easily explained pragmatically with obvious cause. The 2008 solvency event hitting the "consumer of last resort" USA market made the USA specific event a global event. That has created the illusion there is this Rogoff Reinhart "global economy" when there is not. There is the massive hegemon USA economy and then the rest.

As the other sovereign economic units respond to the USA solvency crisis, almost all have resorted to a mercantalistic currency policy. Abenomics, China and now Germany via the Euro reversed the trade weighted decline of the dollar to a consistent 2 1/2% per annum enriching of the dollar on a trade weighted basis. One can see when the dollar has a period of unchanged values then CPI then surges, as we saw in the the 2nd Q 2014. The lack of inflation is solely dollar level caused and explains about 130% of the inflation that would have occurred now given the lack of capacity in the US economy. If the FOMC persists in this gross misread of the current status - and perhaps Fischer does realize that as shown by his recent focus on exchange rates - and seeing that the dollar level has always been an administered rate, established by the US hegemon after considering security needs first then domestic needs second, the dollar will cheapen as it usually does, suddenly, after some keystone forum as the USA asserts their power. Then a calm to cheapening dollar will expose the reality of the tight labor market and little capacity of the US economy. A large surge in inflation will occur to levels that may approach 6%. That is if the Fed carries on with ZIRP.

The BLS, and the CES - who does the heavy lifting and revisions for the BLS - very clearly go over the source of error in the household data and how it is repaired/revised by claims data:

"On an annual basis, the establishment survey incorporates a benchmark revision that re-anchors estimates to nearly complete employment counts available from unemployment insurance tax records. The benchmark helps to control for sampling and modeling errors in the estimates."

And the margin of error for the household data can be substantial:

"...the threshold for a statistically significant change in the household survey is about 400,000..."

(Both quotes from http://www.bls.gov/news.release/empsit.faq.htm )

Given the solvency event was a once in century trend event that experienced a dramtic sudden reversal, it is easy to see that a cumulative error of three or four months has occurred of about 1 million employed.

The US current unemplyment rate is now about 5 1/8%. It is very difficult to refute the above logic. I cannot.

But data clearly shows that the ratio of insured labor force to total labor force has been unusually steady, ever since the large influx of women entered the work force in the 1970s onward. The ratio of insured labor force to labor force does drop similar to the labor force participation rate drop, during the 2008 to 2009 business slowdown, but has corrected swiftly while the labor force participation rate has stayed unchanged.

The weekly initial claims and continuing claims data is accurate and timely. It is not a derived level or rate from a sample as it is comprehensive. But for the ARIMA seasonal adjustments, the insured claims is consistent and accurate and factual. It is what it is. The BLS and CES uses the state data to calibrate and revise the household survey which by definition is a sample, and the establishment business survey that derives payroll. The household and establishment data can only be accurately portrayed with little margin of error every 10 years with the census - but even then that window of accuracy comes as hindsight after the census data is ordered and cleaned. So BLS and CES depend on the above stable ratio to calibrate and revise the household and establishment data using the timely and comprehensive claims data. At least they have done so for the 40 years prior to 2008. But in this solvency event with both the slowdown and then the recovery, BLS and CES have not applied the claims data with the same rigor they have in the past. If they had done so, using the 80% to 85% insured to total labor force ratio, the unemployment rate would have experienced much higher rates at the economic nadir and then much lower rates as we recovered. It is obvious that given the insured labor force to labor force ratio relative stability, the household data is now in error and will have upward revision of approximately 1 million employed.

That would change the current 5.9% unemployment rate to 5.1% unemployment rate raising the labor force participation rate accordingly and eliminating the unusual spread between UER-6 and UER-3.

Here I take the weekly complete census of insured unemployment rate and divide continuing claims by that rate to end with a derived household unemployment rate using insured unemployment and the stability of the ratio of the subset insured labor force to labor force.

The magnitude of this error is shown in the Beveridge Curve for insured unemployment and for household unemployment.

This shows the insured data coordinates to other impressions of the recovery like retail sales, consumer lending, durable goods and especially autos; while the household unemployment data is out of synch with other economic data, including the JOBS data.

Detailed and complex contortions explaining why the household survey is accurate are more and more frequent, but none of these discussions even bother to explain the census based claims data - since it cannot be done - it is simply dismissed or there is some sort of bizarro world parallel universe explanations that claims data only reflects the rate of layoffs. That of course makes no sense when one considers the continuing claims data which drops only as employment picks up.

So the insured data Beveridge Curve is the accurate and complete depiction of the nations employment status.

The reality is the employment levels are showing a near record if not record robust strength that can only occur with a consistent 4% real GDP. The unemployment rate when it is finally revised to the correct level will show that the current unemployment rate is about 5 1/8%.

This means that the FOMC is in the midst of one of the most significant policy errors in the history of the Federal Reserve since 1913. That the whole premise of "forward guidance" is in error as the inflation rate is not related to the output gap, and then the output gap now being used is in error as right now there is no labor slack left and, unless a new internet like technology flows into the economy as it did in the 1990s, heightening productivity, significant inflation given all the capacity being used will certainly occur.

But why is there no inflation now given a correct read of an extremely tight labor market? Where are the wage pressures that theory says should exist now.

That is easily explained pragmatically with obvious cause. The 2008 solvency event hitting the "consumer of last resort" USA market made the USA specific event a global event. That has created the illusion there is this Rogoff Reinhart "global economy" when there is not. There is the massive hegemon USA economy and then the rest.

As the other sovereign economic units respond to the USA solvency crisis, almost all have resorted to a mercantalistic currency policy. Abenomics, China and now Germany via the Euro reversed the trade weighted decline of the dollar to a consistent 2 1/2% per annum enriching of the dollar on a trade weighted basis. One can see when the dollar has a period of unchanged values then CPI then surges, as we saw in the the 2nd Q 2014. The lack of inflation is solely dollar level caused and explains about 130% of the inflation that would have occurred now given the lack of capacity in the US economy. If the FOMC persists in this gross misread of the current status - and perhaps Fischer does realize that as shown by his recent focus on exchange rates - and seeing that the dollar level has always been an administered rate, established by the US hegemon after considering security needs first then domestic needs second, the dollar will cheapen as it usually does, suddenly, after some keystone forum as the USA asserts their power. Then a calm to cheapening dollar will expose the reality of the tight labor market and little capacity of the US economy. A large surge in inflation will occur to levels that may approach 6%. That is if the Fed carries on with ZIRP.

The BLS, and the CES - who does the heavy lifting and revisions for the BLS - very clearly go over the source of error in the household data and how it is repaired/revised by claims data:

"On an annual basis, the establishment survey incorporates a benchmark revision that re-anchors estimates to nearly complete employment counts available from unemployment insurance tax records. The benchmark helps to control for sampling and modeling errors in the estimates."

And the margin of error for the household data can be substantial:

"...the threshold for a statistically significant change in the household survey is about 400,000..."

(Both quotes from http://www.bls.gov/news.release/empsit.faq.htm )

Given the solvency event was a once in century trend event that experienced a dramtic sudden reversal, it is easy to see that a cumulative error of three or four months has occurred of about 1 million employed.

The US current unemplyment rate is now about 5 1/8%. It is very difficult to refute the above logic. I cannot.

Wednesday, October 8, 2014

Ebola is an unsuccessful disease - why is it creating such impact?

Ebola is a lousy and ineffective virus, as a virus goes – at

least in the human sphere. The

epidemiology math “p” factor in morbidity

and virulence is lousy and requires

massive mutation to ever make the big time in becoming a world class killer,

like HIV or ubiquitous malaria.

Retching blood in great agony, or crying tears of blood is

great drama, far more terrifying than night chills of malaria or the sarcoma of

AIDS, and makes great press. And like any

body fluid spreading disease with high levels

of morbidity – and with all the blood and gore – it’s first hit is noted

and effective, to say the least. But the

fact it does kill in such a gruesome high profile way with lots of fluids slopping around, makes it more a terrible and

deadly test of basic infrastructure and public health policy than as a effective killer disease. Most locales have no problem dealing with Ebola, it is a minor though dramtic. Obviously many African locales are failing

utterly.

But Ebola is not a major health risk for the world.

The current press and media are either deliberately doing

great harm so as to sell ad space, or they are maliciously enjoying this

gruesome tale, or they are very poor journalists and have made no effort to

define the story and get the facts. The press coverage on Ebola is close to or is criminal.

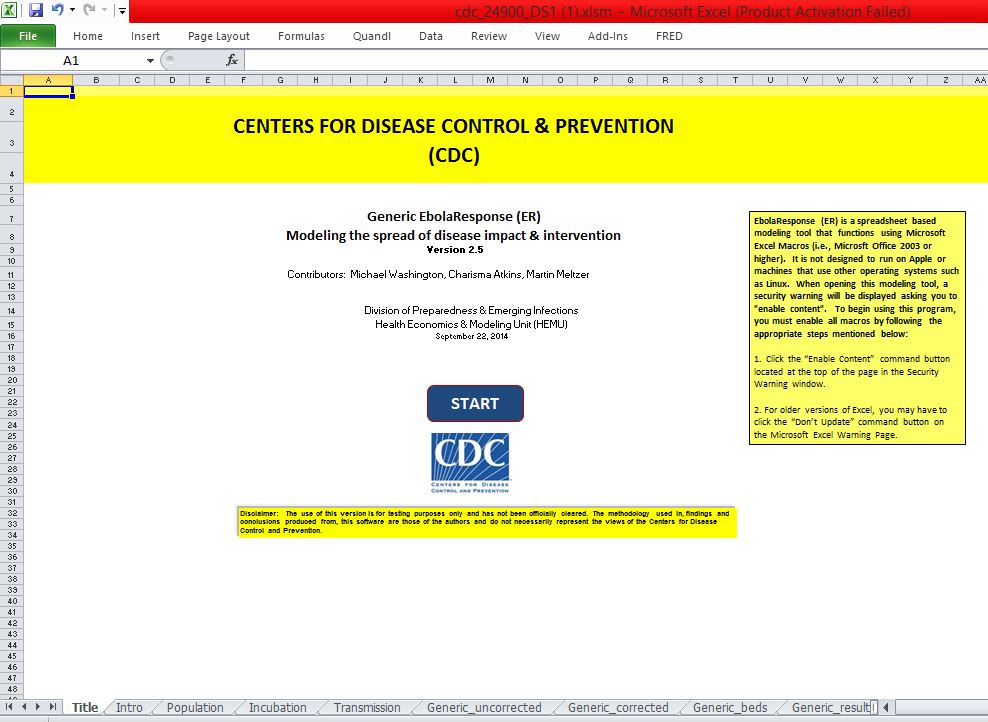

Epidemiology, the science backing the spread of a disease or

condition, is well understood and specific. The Atlanta based CDC has released a model

for Ebola at stacks.cdc.gov/view/cdc/24900 where one can download a easily used Excel spread sheet.

Inputs for

the population of the area of concern; the ground zero beginning carriers

numbers; the infectious time for the

carriers; hospital, home quarantine and

wanderers commitment rates; how

infectious or effective in transmission the disease is while in the hospital,

home quarantine, or wandering around – all these variables can be entered to

find out how many Ebola cases will occur.

Then a 40% mortality rate can be applied to calculate the deaths Ebola

can cause.

I used a very high number of 20 Ebola carriers make it to

the USA and go to 20 different cities, not knowing they have Ebola at first.

But as soon as they are thought to be at risk I have 95% hospitalized, 3% under

home quarantine, and 2% loose in the population. The 20 different locales means this happens

to a population of 200,000,000 (20 times cities of 10MM – obviously a very

dramatic number), and the transmission rate of the disease I use .001% in the

hospital, 5% while in home quarantine

and those wandering around having a 30% infection rate.

The numbers – and keep in mind this is well understood science

with little if no debate in this outcome – well a 5% confidence band which is

what I instructed the CDC model to solve to – comes out with a Ebola, as far as

the US is concerned, a non-event. No Brad Pitt World War Z.

Since this is material is easily found and can be vetted by

those more experienced than I quickly, and since the CDC has made this available

in a very easy form to understand and do “what ifs”, some disturbing

conclusions emerge.

- Why isn’t the CDC and the US public health authorities making this well known? One can conclude that they are spinning Ebola, again from the US perspective, into a monster story into realms of fiction – why? Why aren’t the US public health guys doing their job at a a most critical time of public concern? Why are they allowing this panic to emerge?

- If I am wrong and the public health authorities are making this available to the press – this CDC spread sheet was easily found – why is the press deliberately ignoring the facts and spinning this into a Hollywood horror sci-fi horror movie? If the press is aware I can only see this as one of the most callous if not criminal acts of the press that I can remember.

- Or is the press simply stupid and have been swamped by Twittter and have been reduced to a most ineffective and unprofessional status? If they are bungling to the point of malfeasance the Ebola story – what other stories are they also “blowing”? is this Ebola hack coverage defining?

- This presents a very grim picture of how terrible lifestyle , infrastructure and public policy is for those stricken African countries. If the most basic hygiene were applied or the most basic hygiene applied at mortuary or tending to the dead, or just if everyone would wash hands – Ebola would be as it should be, a bizarre one off event striking like lightening some very unlucky folks.

What is killing Africans is not Ebola, but that a very

easily contained disease like Ebola can kill so many. It is the basic African lifestyle and

infrastructure that is the disease.

Case in point is that Nigeria, not high on many folk’s list of

successful countries, has dealt with Ebola successfully. That is a frighteningly damning for those

countries not dealing with Ebola successfully.

They must be hell on earth. At

the very least all countries need to be brought up to the relative “rich”

levels of Nigeria in terms of public health – at the very least.

Subscribe to:

Posts (Atom)